Why did the U.S. banking crisis of 2007-2008 occur?

Many accounts have chronicled the bad decisions and poor risk management at places like Lehmann Brothers, the now-vanished investment bank.

Still, plenty of banks have vanished, and many countries have had their own banking crises in recent decades. So, to pose the question more generally, why do modern banking crises occur?

David Singer believes he knows.

An MIT professor and head of the Institute’s Department of Political Science, Singer has spent years examining global data on the subject with his colleague Mark Copelovitch, a political scientist at the University of Wisconsin at Madison.

Together, Singer and Copelovitch have identified two things, in tandem, that generate banking crises:

One, a large amount of foreign investment surges into a country, and two, that country’s economy has a well-developed market in securities — especially stocks.

“Empirically, we find that systemic bank failures are more likely when substantial foreign capital inflows meet a financial system with well-developed stock markets,” says Singer.

“Banks take on more risk in these environments, which makes them more prone to collapse.”

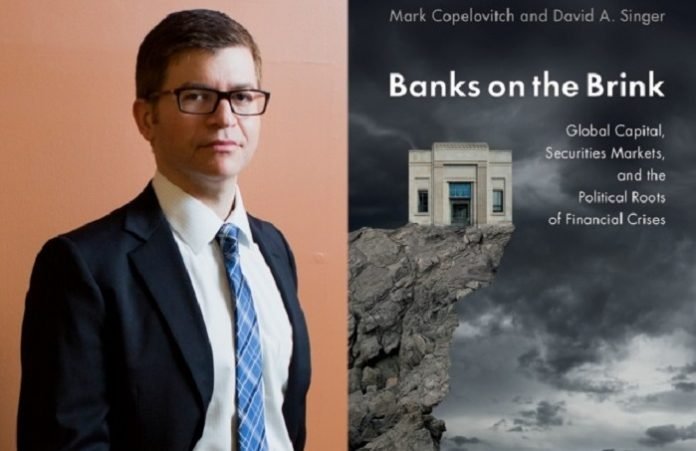

Singer and Copelovitch detail their findings in a new book, “Banks on the Brink: Global Capital, Securities Markets, and the Political Roots of Financial Crises,” published by Cambridge University Press.

In it, they emphasize that the historical development of markets creates conditions ripe for crisis — it is not just a matter of a few rogue bankers engaging in excessive profit-hunting.

“There wasn’t much scholarship that explored the phenomenon from both a political and an economic perspective,” Singer adds. “We sought to go up to 30,000 feet and see what the patterns were, to explain why some banking systems were more resilient than others.”

Where the risk goes: Banks or stocks?

Through history, lending institutions have often been prone to instability. But Singer and Copelovitch examined what makes banks vulnerable under contemporary conditions.

They looked at economic and banking-sector data from 1976-2011, for the 32 countries in the Organization for Economic Cooperation and Development (OECD).

That time period begins soon after the Bretton Woods system of international monetary-policy cooperation vanished, which led to a significant increase in foreign capital movement.

From 1990 to 2005 alone, international capital flow increased from $1 trillion to $12 trillion annually. (It has since slid back to $5 trillion, after the Great Recession.)

Even so, a flood of capital entering a country is not enough, by itself, to send a banking sector under water, Singer says: “Why is it that some capital inflows can be accommodated and channeled productively throughout an economy, but other times they seem to lead a banking system to go awry?”

The answer, Singer and Copelovitch contend, is that a highly active stock market is a form of competition for the banking sector, to which banks respond by taking greater risks.

To see why, imagine a promising business needs capital. It could borrow funds from a bank. Or it could issue a stock offering, and raise the money from investors, as riskier firms generally do. If a lot of foreign investment enters a country, backing firms that issue stock offerings, bankers will want a piece of the action.

“Banks and stock markets are competing for the business of firms that need to raise money,” Singer says. “When stock markets are small and unsophisticated, there’s not much competition. Firms go to their banks.”

However, he adds, “A bank doesn’t want to lose a good chunk of its customer base to the stock markets. … And if that happens, banks start to do business with slightly riskier firms.”

Rethinking Canadian bank stability

Exploring this point in depth, the book develops contrasting case studies of Canada and Germany.

Canada is one of the few countries to remain blissfully free of banking crises — something commentators usually ascribe to sensible regulation.

However, Singer and Copelovitch observe, Canada has always had small, regional stock markets, and is the only OECD country without a national stock-market regulator.

“There’s a sense that Canada has stable banks just because they’re well-regulated,” Singer says. “That’s the conventional wisdom we’re trying to poke holes in. And I think it’s not well-understood that Canada’s stock markets are as underdeveloped as they are.”

He adds: “That’s one of the key considerations, when we analyze why Canada’s banks are so stable. They don’t face a competitive threat from stock markets the way banks in the United States do. They can be conservative and be competitive and still be profitable.”

By contrast, German banks have been involved in many banking blowups in the last two decades. At one time, that would not have been the case.

But Germany’s national-scale banks, feeling pressure from a thriving set of regional banks, tried to bolster profits through securities investment, leading to some notable problems.

“Germany started off the period we study looking like a very bank-centric economy,” Singer says. “And that’s what Germany is often known for, close connections between banks and industry.”

However, he notes, “The national banks started to feel a competitive threat and looked to stock markets to bolster their competitive advantage. … German banks used to be so stable and so long-term focused, and they’re now finding short-term trouble.”

“Banks on the Brink” has drawn praise from other scholars in the field. Jeffry Frieden, a professor of government at Harvard University, says the book’s “careful logic, statistical analyses, and detailed case studies make compelling reading for anyone interested in the economics and politics of finance.”

For their part, Singer and Copelovitch say they hope to generate more discussion about both the recent history of banking crises, and how to avoid them in the future.

Perhaps surprisingly, Singer believes that separating commerical and investment banks from each other — which the Glass-Steagall Act used to do in the U.S. — would not prevent crises. Any bank, not just investment banks, can flounder if profit-hunting in risky territory.

Instead, Singer says, “We think macroprudential regulations for banks are the way to go.

That’s just about capital regulations, making sure banks are holding enough capital to absorb any losses they might incur. That seems to be the best approach to maintaining a stable banking system, especially in the face of large capital flows.”

Written by Peter Dizikes.